Notes on Business Concepts

KPI

Conversion rate

Click-Through Rate (CTR)

ROI

Leadership/Communciation/Soft Skills

Medium: Most Essential Skills for Data Scientists

Mindset

Read every day; Embrace change; Compliment; Forgive others; Talk about ideas; Continuously learn; Accept responsibility for failures; Have a sense of gratitude; Set goals; Develop life plans

Data Policy

-

Ethics

-

Data governance

-

Capability that enables an organization to ensure that high data quality exists throughout the complete lifecycle of the data

-

Focus areas of data governance include availability, usability, consistency, data integrity and data security

Algorithmic Marketing

Relevant Textbook: Introduction to Algorithmic Marketing: Artificial Intelligence for Marketing Operations

Articles:

HBR: You Need an Algorithm, Not a Data Scientist

HBR: The Perils of Algorithm-Based Marketing

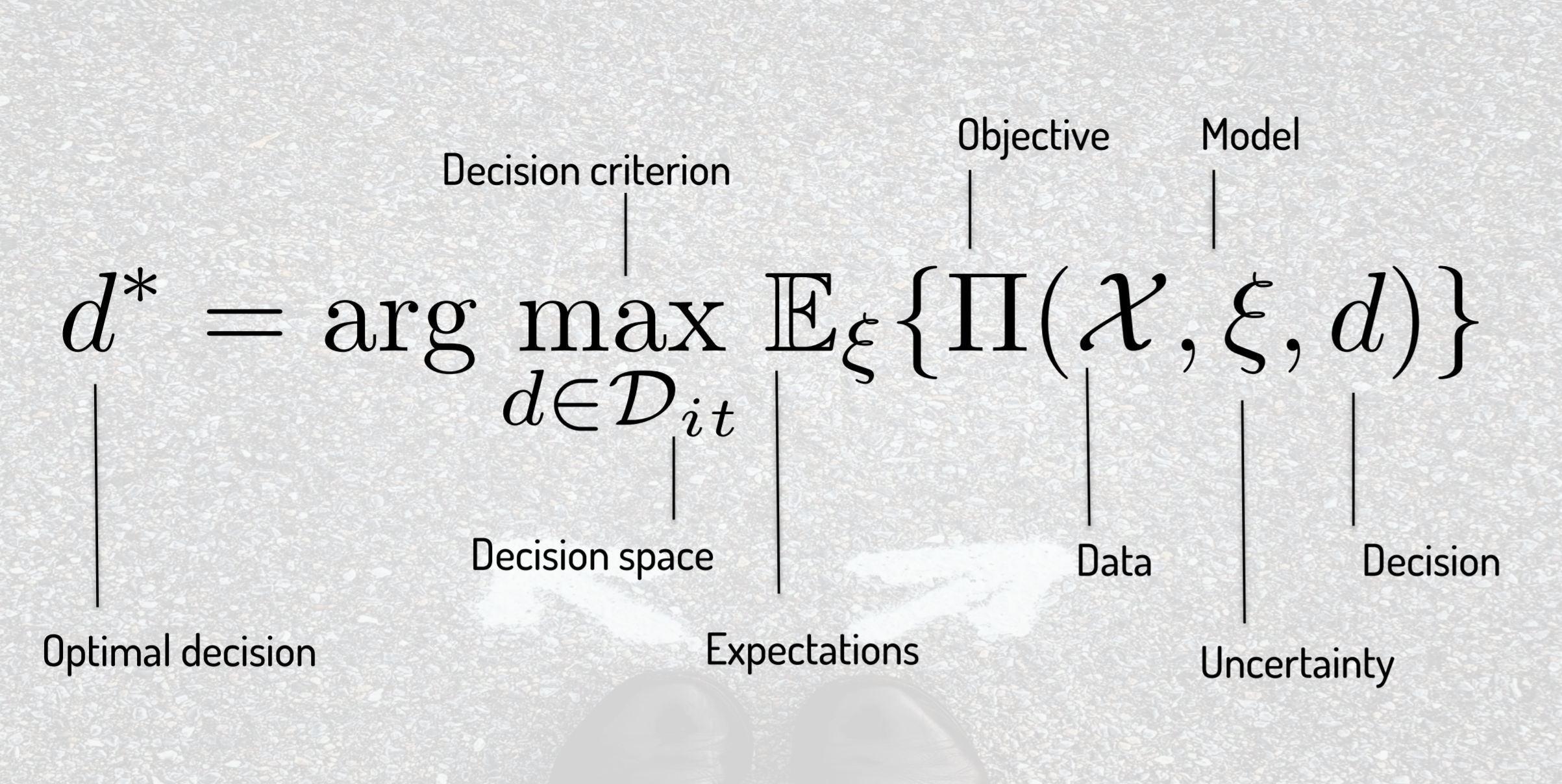

Decisions and Algorithms

-

“An algorithm is any well-defined computational procedure that takes some value, or set of values, as input and produces some value, or set of values as output.” —CLRS Algorithms Textbook

-

“Algorithmic marketing refers to the use of computational methods to make, implement, monitor or improve marketing decisions based on available informational inputs.” —Sanjog Misra

-

A decision is an algorithm that outputs choices as a function of inputs to attain a goal (d = f(outcome, choices, models, data…)).

-

Building algorithms and softwares at scale to make decisions automatically, rather than people make decisions and repeat the process. (HOTW: “hands off the wheel” @ Amazon)

-

Prediction != Decision (Prediction relies on finding patterns in the ast data; Decision is much more complex and uncertain)

-

Steps: Objectives -> Theory -> Model -> Data -> Methods -> Implementation -> Monitoring -> Adaptation

(Chicago approach: Theory before the Model and Data)

- Example:

Objective: max profits

Theory (Data Generating Process):

- \[\pi = R - C = P*Q-MC*Q-FC = (P-MC)*Q(P...)-FC\]

- Consumers maxmize utility when making choices

Model: Demand function/Discrete choice, \(Q = a+b*P+\epsilon\)

(In marketing, we are interested in predicting a and b, as they tell us how P changes Q)

Data: Collect data on price experiments

Methods: Optimization

Ex. Find the optimal price

pstar = function (a=10, b=-2, mc=1){

# Quantity Demand Function

q = function(p){return(a+b*p)}

rev = function(p){return(p*q(p))}

cost = function(p){return(mc*q(p))}

profit = function(p){return (rev(p) - cost(p))}

result = optimize(profit, lower=1, upper=10, tol=1e-10, maximum = TRUE)

pstar = result$maximum

return(pstar)

}

# Call the function

pstar()

# optimal price is 3

curve(profits, 1, 10)

# Find Minimum

res = optimize(profits,interval=c(1,10), maximum=TRUE)

# Plot that point

points(x=res$maximum, y=res$objective,pch=19,col='red',cex=1.5)

# Stimulate data

set.seed = 1000

N = 1000

ps = runif(N) # prices as uniform random number between 0 and 1

qs = 10 - 2*ps + rnorm(N)

out = lm(qs~ps)

summary(out)

cf = coef(out)

pstar(cf[1], cf[2], 1)

# optimal price is 2.94

Digital Audiences

Look-alike Model

the people-based method of targeting prospects who are the most like your best customers

Adv over traditional targeting: Use ML models to predict customers’ values instead of just demographic variables

Recommendation Systems

Matching Algorithms

Personalization & Content Optimization

Programmatic Advertising

Demand side platform (DSP)

Real time bidding (RTB) auction

Targeting and Retargeting

Price Customization

Multi Touch Attribution

Marketing Strategy

4P

Price, Product, Place, Promotion

3C

Comapny, Customer, Competitor

Attribution

Ex. improve attribution models and measure incremental lifts

Segmentation

Response modeling

User engagement

Conversion

Churn Prediction

Propensity

Customer Life Time Value

RFM (customer value)

Funnel conversion

Reactivation model

Bass Model

Consumer Choice Model

Conjoint Analysis

Price elasticity models

Competitive intelligence

Market Research

Interviews

Task-based usability testing

Focus groups

Consumer satisfaction

Supply chain / logistics

Network optimization

Inventory optimization

Product flow analysis

Operations planning

Production planning

Vehicle route optimization

Discrete event simulation

Financial accounting

Behavioral Economics/Consumer Behavior

Heuristics and Biases

Prospect Theory

-

Also known as “loss-aversion theory”

-

Psychological theory of decision-making under conditions of risk

-

Original paper: Kahneman and Tversky, 1979 in Econometrica

-

For investors:

-

The prospect theory says that investors value gains and losses differently, placing more weight on perceived gains versus perceived losses.

-

An investor presented with a choice, both equal, will choose the one presented in terms of potential gains.

-

The prospect theory is part of behavioral economics, suggesting investors chose perceived gains because losses cause a greater emotional impact.

4.The certainty effect says individuals prefer certain outcomes over probable ones, while the isolation effect says individuals cancel out similar information when making a decision.

From Investopedia-Prospect Theory

Reference-Dependent Preferences

when utility from an outcome depends on comparisons to relevant “reference levels” or “reference points.”

Loss Aversion

people dislike losses relative to the reference point more than they like same-sized gains.

Leave a Comment